How to Apply for Akhuwat Loan

Welcome to Akhuwat Loan Apply, your gateway to financial empowerment and prosperity. In today’s dynamic and ever-evolving economic landscape, attaining financial freedom transcends being merely a goal; it represents a journey toward a brighter, more secure future. At Akhuwat Loan Apply, we understand the importance of financial independence and are dedicated to providing you with the tools, resources, and support you need to unlock your true potential and realize your dreams.

NOTICE: We have recently become aware of individuals impersonating Akhuwat Foundation representatives and soliciting money from the public. Before engaging with anyone claiming to represent Akhuwat Foundation, verify their credentials with us. Remember, only Akhuwat Foundation grants loans, and any suspicious activities should be reported immediately. Stay vigilant and contact us directly for any concerns or verification. Thank you for your cooperation.

- We have recently become aware of individuals impersonating Akhuwat Foundation representatives and soliciting money from the public. Before engaging with anyone claiming to represent Akhuwat Foundation, verify their credentials with us. Remember, only Akhuwat Foundation grants loans, and any suspicious activities should be reported immediately. Stay vigilant and contact us directly for any concerns or verification. Thank you for your cooperation.

The Essence of Financial Freedom

Financial freedom is the cornerstone of a fulfilling and rewarding life. It’s about having the ability to make choices that align with your goals, values, and aspirations without being hindered by financial constraints. In this chapter, we delve deep into the essence of financial freedom, exploring what it means to be financially independent and how you can achieve this state of empowerment with the help of Akhuwat Loan Apply.

Check Your Loan Status Online

Now you can apply for an Akhuwat loan online and check your loan status by entering your valid CNIC number and the mobile number provided by the Akhuwat Loan Department. If you have any problems with checking your loan online, please call the Akhuwat Loan WhatsApp Helpline Number for assistance.

How to Check Akhuwat Loan Status Online

When you take a loan from Akhuwat, it should also have a mechanism to check your loan status so that you know how many installments you have paid and how much is left. This feature was recently introduced by the Akhuwat Foundation on their official website, where users can know the status of their loan by entering their ID card number and mobile number/file number.

Simple Steps to Apply for Akhuwat Loan

- Visit the official website of the Akhuwat Foundation.

- Find the loan check system there and enter your ID card number and mobile number to know the status of your loan.

- Press the check loan button, and your Akhuwat Foundation loan status will appear, showing all the information about your loan.

- If you need assistance, call the Akhuwat head office contact number, and a representative will guide you.

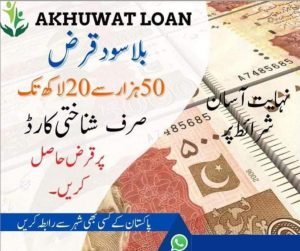

Akhuwat Foundation Loan Scheme

Akhuwat Foundation has launched a beneficial scheme for everyone. It is accessible with minimal proof, and no significant proof is required. The foundation has introduced a limit that everyone can use easily, making Akhuwat Foundation very popular across Pakistan.

If you don’t understand this method, then you don’t have to worry at all, you have to call the Akhuwat head office contact number immediately and our representative will guide you better.

The Akhuwat Advantage

A Legacy of Trust

With a rich history grounded in compassion, integrity, and community service, Akhuwat Loan Apply is more than just a financial institution. For over a decade, we’ve been committed to empowering individuals and communities through our innovative financial solutions and unwavering dedication to social impact.

Comprehensive Financial Solutions

From personal loans and business financing to microfinance and beyond, Akhuwat Foundation offers a diverse range of financial products and services tailored to meet your unique needs and aspirations. Whether you’re a budding entrepreneur, a seasoned professional, or a community leader, we’re here to support you every step of the way.

Customer-Centric Approach

Your satisfaction is our top priority. Our team of experienced professionals is dedicated to providing you with personalized service, transparent communication, and unparalleled support throughout your journey with us.

Empowering Dreams, Transforming Lives

At Akhuwat Foundation, we believe that every individual deserves the opportunity to pursue their dreams and achieve their full potential. Whether you’re looking to start a new business, expand your existing operations, or pursue personal goals and aspirations, we’re here to help you turn your dreams into reality.

Our Commitment to Excellence

Ethical Practices

Integrity, honesty, and transparency are the pillars of our organization. We adhere to the highest ethical standards in everything we do, ensuring that our customers receive fair, transparent, and ethical treatment at all times.

Social Responsibility

Beyond profits, we measure our success by the positive impact we create in the communities we serve. Through our social initiatives, community development programs, and strategic partnerships, we’re committed to driving sustainable change and making a meaningful difference in the lives of those who need it most.

Continuous Innovation

In today’s fast-paced world, innovation is key to staying ahead of the curve. We’re constantly exploring new ideas, technologies, and strategies to improve our products, services, and customer experience.

Financial Literacy: The Key to Success

Understanding Financial Basics

Financial literacy is the foundation of financial independence. We cover essential financial concepts such as budgeting, saving, investing, and debt management. By mastering these fundamentals, you’ll be better equipped to make informed financial decisions and achieve your long-term goals.

Building a Budget

A budget is a roadmap to financial success. Learn how to create a realistic budget that aligns with your income, expenses, and financial goals. We provide practical tips and strategies for budgeting effectively, tracking your spending, and making adjustments as needed to stay on track.

The Power of Saving

Saving money is the cornerstone of wealth-building. Explore the benefits of regular saving, whether it’s for emergencies, short-term goals, or retirement. We delve into different saving strategies, such as automatic transfers, high-yield savings accounts, and retirement plans.

Investing for the Future

Introduction to Investing

Investing is essential for building wealth and achieving long-term financial security. We unravel the complexities of investing, covering essential principles like risk, return, diversification, and asset allocation.

Building an Investment Portfolio

A well-diversified investment portfolio is crucial for managing risk and maximizing returns. Learn how to create a diversified portfolio aligned with your risk tolerance, investment goals, and time frame.

Investing for Retirement

Planning for retirement is one of the most important financial goals. We explore the different retirement planning options available, including employer-sponsored plans and individual retirement accounts.

Navigating Financial Challenges

Managing Debt

Debt can be a significant obstacle to financial freedom if not managed properly. We discuss strategies for managing debt responsibly, including debt consolidation, refinancing, and repayment plans.

Overcoming Financial Obstacles

Life is full of unexpected challenges, but with the right mindset and strategies, you can overcome them. We provide tips and guidance on navigating financial difficulties and coming out stronger.

Protecting Your Assets

Protecting your assets is essential for safeguarding your financial future. From insurance coverage to estate planning, we discuss various strategies for protecting your wealth and ensuring your loved ones are taken care of in unforeseen circumstances.

Building Wealth and Giving Back

Creating Generational Wealth

Building wealth is about creating a lasting legacy for future generations. Learn how to build generational wealth through smart investing, strategic planning, and responsible financial management.

Giving Back to the Community

As you achieve financial success, it’s important to give back and make a positive impact in your community. Discover the joy of philanthropy and volunteerism and find meaningful ways to give back through charitable donations and community service.

The Future of Financial Education

Embracing Technology

In an increasingly digital world, technology plays a vital role in shaping the future of financial education. Explore innovative tools and platforms that make learning about personal finance more accessible, engaging, and interactive.

Expanding Access to Financial Education

Access to quality financial education is essential for promoting economic empowerment and social mobility. Learn about initiatives and programs aimed at expanding access to financial education for underserved communities.

Promoting Financial Inclusion

Financial inclusion is key to reducing poverty and fostering sustainable economic development. We discuss approaches to promoting financial inclusion, including expanding access to affordable banking services and microfinance initiatives.

Your Financial Journey Begins Here

Congratulations! You’ve reached the end of this comprehensive guide to financial literacy and empowerment. Armed with the knowledge, skills, and resources provided in this guide, you’re now ready to embark on your journey to financial freedom and success. Remember, achieving financial independence is a lifelong process that requires dedication, discipline, and continuous learning.

At Akhuwat Foundation, we’re here to support you every step of the way. From personal loans and credit cards to investment advice and retirement planning, we have everything you need to achieve your financial dreams.

Thank you for choosing Akhuwat Foundation as your trusted financial partner. We look forward to helping you achieve your goals and build a brighter, more prosperous future. Together, let’s unlock the doors to financial freedom and create a world where everyone has the opportunity to thrive.

History of Akhuwat Foundation

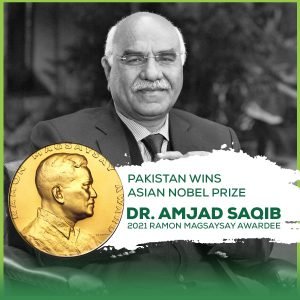

Founding of Akhuwat Foundation

Akhuwat Foundation was established in 2001 by Dr. Amjad Saqib with the revolutionary idea of providing interest-free microfinance to the poor. It started with a modest loan of Rs. 10,000 given to a widow, and today it has grown into the largest interest-free microfinance institution in the world.

Key Milestones

Over the years, Akhuwat has achieved numerous milestones, such as the expansion of its loan portfolio, launching educational initiatives, and introducing health services. Each milestone marks a significant step towards poverty alleviation and community empowerment.

Core Principles of Akhuwat Foundation

- Compassion and Empathy: At the heart of Akhuwat’s operations is compassion. They believe in uplifting the less fortunate with empathy, ensuring that their dignity is preserved.

- Community Participation: Akhuwat’s model relies heavily on community involvement. By fostering a sense of ownership among borrowers, the foundation ensures high repayment rates and community solidarity.

- Transparency and Integrity: Upholding the highest standards of transparency and integrity, Akhuwat ensures that all its operations are conducted with utmost honesty and openness.

Akhuwat’s Diverse Portfolio

Interest-Free Loans

Akhuwat’s primary offering is interest-free loans for various purposes including business setup, education, health, and housing. These loans are designed to provide immediate relief and long-term support to borrowers.

Educational Services

Akhuwat has expanded its reach into education by establishing schools and providing scholarships to deserving students. Their goal is to promote education as a means of breaking the cycle of poverty.

Health Services

Recognizing the importance of health in economic stability, Akhuwat offers health services including medical camps, clinics, and partnerships with hospitals to provide affordable healthcare to the underserved.

How to Apply for Akhuwat Loan

Eligibility Criteria

To apply for an Akhuwat loan, applicants must meet certain eligibility criteria such as being a Pakistani citizen, having a verifiable source of income, and demonstrating a genuine need for financial assistance.

Application Process

- Step 1: Visit the nearest Akhuwat branch or access their official website.

- Step 2: Fill out the loan application form with accurate personal and financial details.

- Step 3: Submit the required documents including CNIC, proof of income, and references.

- Step 4: Wait for the loan application to be processed and reviewed by Akhuwat’s team.

- Step 5: If approved, receive the loan amount and use it as per the agreed terms.

Repayment and Support

Akhuwat offers flexible repayment options tailored to the borrower’s financial situation. Regular follow-ups and support are provided to ensure timely repayments and successful utilization of the loan.

Akhuwat’s Impact on Society

Empowering Women

A significant portion of Akhuwat’s loans are directed towards women entrepreneurs, empowering them to start and grow their own businesses. This has not only improved their economic status but also enhanced their social standing.

Supporting Small Businesses

By providing interest-free loans to small business owners, Akhuwat has played a crucial role in boosting local economies and creating job opportunities. Many small businesses have thrived and expanded, thanks to Akhuwat’s support.

Promoting Education

Akhuwat’s educational initiatives have enabled countless students to pursue their dreams and achieve academic excellence. By removing financial barriers, they have made education accessible to all.

Testimonials and Success Stories

Inspiring Journeys

- Ayesha’s Tale: Ayesha, a single mother, used an Akhuwat loan to start a tailoring business. Today, she employs several other women and has become a pillar of her community.

- Ali’s Enterprise: Ali, a young entrepreneur, expanded his small grocery store with the help of an Akhuwat loan. His business now serves a larger community and provides employment to several individuals.

Community Transformation

Communities across Pakistan have experienced transformative change due to Akhuwat’s efforts. Increased financial stability, improved educational opportunities, and better healthcare have led to overall community upliftment.

The Future of Akhuwat Foundation

Expansion Plans

Akhuwat aims to expand its reach further by opening more branches and introducing new services. Their vision is to cover every corner of Pakistan and beyond, ensuring that no one is left behind.

Digital Initiatives

Embracing technology, Akhuwat plans to introduce digital platforms for easier access to loans and services. This will make the application process more efficient and transparent.

Sustainable Development Goals

Akhuwat is committed to contributing towards the United Nations Sustainable Development Goals (SDGs) by focusing on poverty alleviation, quality education, gender equality, and economic growth.

Empowering the Underserved: Akhuwat’s Role in Financial Inclusion

In the quest for financial inclusion, Akhuwat Foundation has emerged as a pivotal force, bridging the gap between marginalized communities and financial services. This section delves into the broader impact of Akhuwat’s initiatives on financial inclusion in Pakistan and beyond.

Reaching the Unbanked

A significant portion of the population in developing countries remains unbanked, lacking access to formal financial institutions. Akhuwat’s interest-free microfinance model has provided a lifeline to these individuals, offering them a chance to participate in the economic mainstream. By offering loans without interest, Akhuwat removes a major barrier that often prevents the poor from seeking financial assistance.

Empowering Marginalized Communities

Akhuwat’s services are designed to uplift the most vulnerable segments of society, including women, minorities, and rural communities. Through targeted loan programs, Akhuwat empowers these groups to start small businesses, pursue education, and improve their living conditions. This not only enhances their economic status but also fosters social inclusion and equality.

Building Financial Literacy

Financial literacy is a cornerstone of financial inclusion. Akhuwat places a strong emphasis on educating its borrowers about financial management, savings, and investment. Workshops, training sessions, and one-on-one counseling are integral parts of Akhuwat’s approach, ensuring that borrowers are equipped with the knowledge and skills to manage their finances effectively.

Collaborations and Partnerships

Akhuwat’s success is bolstered by its strategic collaborations and partnerships with various stakeholders, including government bodies, non-governmental organizations (NGOs), and the private sector. These partnerships enhance Akhuwat’s capacity to reach more beneficiaries and deliver a wider range of services.

Government Collaboration

Akhuwat works closely with government agencies to align its programs with national development goals. Through these collaborations, Akhuwat can leverage government resources and infrastructure to expand its reach and impact. Joint initiatives often focus on poverty alleviation, women’s empowerment, and rural development.

NGO Partnerships

Partnerships with other NGOs allow Akhuwat to create a more comprehensive support system for its beneficiaries. By working together, NGOs can provide complementary services such as healthcare, education, and vocational training, creating a holistic approach to community development.

Private Sector Engagement

Engaging with the private sector opens up opportunities for innovation and funding. Corporate partnerships can provide financial support, technical expertise, and access to new markets. Akhuwat’s collaboration with private enterprises also promotes corporate social responsibility, encouraging businesses to contribute to social development.

Innovations in Microfinance

Akhuwat is continually exploring innovative approaches to enhance its microfinance model and better serve its beneficiaries. These innovations include the use of technology, new financial products, and improved service delivery methods.

Digital Financial Services

The integration of digital technologies in microfinance is transforming the way financial services are delivered. Akhuwat is adopting digital platforms to streamline loan applications, disbursements, and repayments. Mobile banking and online portals provide borrowers with convenient access to their accounts, reducing the need for physical visits to branches.

Product Diversification

Akhuwat is expanding its portfolio to include a variety of financial products tailored to the diverse needs of its borrowers. In addition to interest-free loans, Akhuwat offers savings schemes, insurance products, and investment opportunities. This diversification ensures that borrowers have access to comprehensive financial services that support their long-term goals.

Enhanced Service Delivery

Improving service delivery is crucial for maintaining borrower satisfaction and ensuring the sustainability of microfinance programs. Akhuwat invests in staff training and capacity building to enhance the quality of its services. By adopting best practices in customer service and leveraging technology, Akhuwat ensures that its beneficiaries receive timely and efficient support.

Measuring Impact and Success

The impact of Akhuwat’s initiatives is measured through rigorous monitoring and evaluation processes. These assessments help Akhuwat understand the effectiveness of its programs, identify areas for improvement, and demonstrate the value of its work to stakeholders.

Social Impact Assessment

Social impact assessments evaluate the broader effects of Akhuwat’s programs on communities and individuals. These assessments consider factors such as improved living standards, increased economic activity, and enhanced social cohesion. By measuring social impact, Akhuwat can ensure that its programs are delivering meaningful and lasting benefits.

Financial Performance Metrics

Monitoring financial performance is essential for maintaining the sustainability of microfinance operations. Akhuwat tracks key financial indicators such as loan repayment rates, portfolio quality, and operational efficiency. These metrics provide insights into the health of Akhuwat’s financial services and inform strategic decision-making.

Beneficiary Feedback

Feedback from beneficiaries is a valuable source of information for continuous improvement. Akhuwat regularly collects feedback from its borrowers to understand their experiences, challenges, and needs. This feedback informs program adjustments and helps Akhuwat tailor its services to better meet the needs of its target audience.

Challenges and Future Directions

Despite its successes, Akhuwat faces several challenges in its mission to promote financial inclusion and empowerment. Addressing these challenges is crucial for sustaining and expanding its impact.

Scaling Operations

As Akhuwat continues to grow, scaling its operations to reach more beneficiaries poses a significant challenge. This requires substantial financial resources, operational capacity, and strategic planning. Akhuwat is exploring innovative funding mechanisms, such as impact investing and crowdfunding, to support its expansion efforts.

Navigating Regulatory Environments

Operating in diverse regulatory environments can be complex and challenging. Akhuwat must navigate various legal and regulatory frameworks to ensure compliance and maintain its operations. Engaging with policymakers and advocating for supportive regulatory environments are key strategies for overcoming these challenges.

Ensuring Sustainability

Ensuring the sustainability of microfinance programs is critical for long-term impact. Akhuwat focuses on building strong financial foundations, diversifying funding sources, and adopting sustainable business practices. By prioritizing sustainability, Akhuwat can continue to serve its beneficiaries effectively in the years to come.

Conclusion: A Vision for the Future

Akhuwat Foundation’s journey is a testament to the power of compassion, innovation, and community spirit. By providing interest-free microfinance and comprehensive support services, Akhuwat has empowered millions of individuals to achieve financial independence and improve their lives. As Akhuwat looks to the future, it remains committed to its mission of promoting financial inclusion, uplifting communities, and fostering sustainable development.

Join us in supporting Akhuwat Foundation and be a part of this transformative journey. Together, we can create a world where everyone has the opportunity to thrive, regardless of their financial circumstances.

Get Involved

There are many ways you can get involved with Akhuwat Foundation and contribute to its mission of financial empowerment and community development.

Donate

Your donations can make a significant impact on the lives of those in need. By contributing to Akhuwat, you support interest-free microfinance, education, healthcare, and various community development initiatives. Every donation, no matter how small, helps us bring positive change.

Volunteer

Volunteering your time and skills is another way to support Akhuwat’s mission. Whether you’re a financial expert, educator, healthcare professional, or simply passionate about helping others, there are numerous opportunities to get involved and make a difference.

Spread the Word

Raising awareness about Akhuwat’s work is crucial for garnering support and expanding our reach. Share our story with your friends, family, and social networks. Advocate for financial inclusion and support for marginalized communities in your circles.

Partner with Us

If you represent an organization, consider partnering with Akhuwat to create impactful programs and initiatives. Collaborative efforts amplify our impact and bring diverse resources and expertise to our mission.

Final Thoughts

Akhuwat Foundation’s story is one of hope, resilience, and unwavering dedication to serving humanity. As we continue to expand our reach and impact, we invite you to join us on this journey. Together, we can create a world where financial freedom and prosperity are within reach for everyone. Let’s build a future where no one is left behind, and every individual has the opportunity to thrive.